BY ETHAN ORR, R-TUCSON, DIST. 9 | JANUARY 29, 2014

Arizona’s financial responsibility law is dangerously irresponsible

About a year ago a good friend and his fiancé were riding their bikes in the bike lane when they were hit from behind by car. My friend’s fiancé is almost completely recovered, but he is still going through rehabilitation and is now considering an operation that will fuse four of his spinal disks.

The driver who hit my friend had only the minimum insurance coverage that Arizona requires, and that was not even enough to cover their first day in the emergency room.

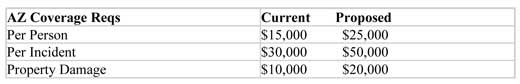

The last time Arizona updated its automobile insurance requirements was 1972. The mandatory minimum for bodily injury was set to $15,000. More than 40 years later that is where the mandatory minimum remains.

These limits are dangerously low. For Arizona to move forward responsibly, it needs to update its “financial responsibility law” when it comes to mandatory minimums for car insurance. That is my goal with House Bill 2165.

My proposal is not drastic. The bill raises the minimum coverage requirements to $25,000 per person, $50,000 per incident and $20,000 for property damage. Those figures are far from the highest in the country and are very close to the national average. Moreover, the Arizona Department of Transportation reports that the economic cost of a non-fatal injury car crash ranges from $23,000 to $72,000 per person.

The quick conclusion by some that raising minimum insurance requirements would increase the number of uninsured motorists on our roads is not supported by the data. Florida, a state with the lowest minimum coverage requirements in the nation, has one of the highest rates of uninsured drivers at 24 percent. Likewise, Maine, which has the highest minimum coverage requirements in the nation, has one of the lowest rates of uninsured drivers in the nation at 5 percent.

There is no correlation between minimum coverage requirements and the rate of uninsured drivers. Instead, research shows that the rate of uninsured drivers is related mostly to how stringently states enforce financial responsibility laws. As a result, I expect that when House Bill 2165 is signed into law, Arizona’s relatively low uninsured rate of 12 percent will continue to remain below the national average of 14 percent.

Premiums will increase, but this is more complex than it seems. On the one hand, it is true that those who purchase only the minimum limits will face slightly higher premiums. The insurance industry estimates, however, premiums will increase only about $5 per month, the cost of having a meal once a month at a fast food restaurant.

On the other hand, raising the minimum limits may result in lower costs to consumers who for decades have had to pay higher premiums because of accidents caused by underinsured motorists.

My friend, thankfully, is physically strong and is getting help from his employer, but the sad reality is that the medical costs may force him into bankrupting anyway.

My bill would not have made a difference in my friend’s situation, but in situations where the injuries are not as severe, it will. Insurers and drivers will all benefit if we accept that our minimums are too low and raise them.

It is time for our minimum insurance limits to bear some resemblance to today’s modern economy, and for every Arizona to take responsible for insuring themselves adequately.