BY LINDA BENTLEY | JANUARY 4, 2012

Rural/Metro pushes to form Rio Verde Fire District

RIO VERDE – Signatures are currently being collected to form the Rio Verde Foothills County Island Fire District (RVFCIFD), otherwise known as a special taxing district.

RIO VERDE – Signatures are currently being collected to form the Rio Verde Foothills County Island Fire District (RVFCIFD), otherwise known as a special taxing district.

Rural/Metro Fire is at the helm and is footing the bill to collect enough signatures to get it through this time.

It’s been tried before and failed back in 2005 when assessed property valuation within the proposed area totaled just less than $60 million.

The Impact Statement for the RVFCIFD filed in 2005 estimated a tax rate of $2.50 per $100 of valuation and used a $300,000 house with an assessed value of $30,000 for its example, reflecting an increased tax liability of $750.

It’s not clear, however, what the district’s boundaries were in 2005.

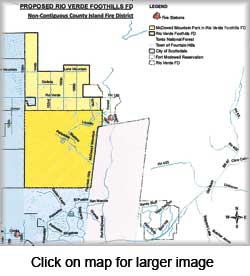

The current proposal is bounded by the city limits of Scottsdale on the west (approximately 136th Street), by the town of Fountain Hills on the south, the Fort McDowell Mohave-Apache Native Community on the east and by the Tonto National Forest on the north and east, excluding any portion lying in the existing Rio Verde Fire District.

It contains approximately 32,626 acres, including the 21,099-acre McDowell Mountain Regional Park, and encompasses 3,896 parcels of land.

Because McDowell Mountain Regional Park, comprising almost two-thirds of the district, is owned by Maricopa County, it is tax exempt and therefore is not included in the $95.3 million of assessed property valuation and will contribute no funding to the district.

The 2011 Impact Statement uses a home valued at $226,600 for an example of the typical residence in the area, which, with a tax rate of $1.61 would result in an increased tax liability of $365.

The budget for the first year is $1,875,750.

While Rural/Metro estimates $1.6 million will cover the cost of services, the budget includes an additional $275,750 for “administrative, general governance and one-time district formation expenses.”

Since Rural/Metro has engaged the services of Black Top Strategies, LLC to collect signatures, taxpayers will be reimbursing Rural/Metro for the costs of ensuring they become part of a special taxing district.

According to Rural/Metro Chief Dan Caudle, the plan is for Rural/Metro to purchase a home within the most heavily populated area of the district. That would provide housing for firefighters and access to water. A metal building could then be erected on the property to house the firefighting vehicles and equipment.

Although they have a year from Nov. 30, 2011 to collect 1,559 signatures, (more than one half of the aggregate number of property owners in the county island area contained in the proposed district, as required by statute) Caudle said they are hoping to collect the requisite number of signatures by mid January to make the deadline to levy taxes this year.

According to fire district proponents, Rio Verde Foothills residents were advised last August that the Rio Verde Fire District, which services the community of Rio Verde to the east of the proposed district, would no longer respond to calls for fire and emergency medical services in the foothills area, as it is out of their designated district.

As a result, the closest fire station would be over 20 miles away, causing a “dramatic increase in response times for services such as house fires, wildfires, emergency medical incidents, hazardous materials incidents, desert pest removal, floods and other rescues.”

There’s no water, for the most part, in the Rio Verde area and there are no fire hydrants.

Rural/Metro would need to obtain a water truck in addition to all the other equipment.

Unlike the upcoming Cave Creek ballot measure to impose a property tax for contracted services with Rural/Metro, the RVFCIFD forms a special taxing district directly through signing the petition. There is no election. Once the requisite number of signatures is collected, the taxing district is formed.

Although Rural/Metro says it contracted with Black Top Strategies, LLC, there is no such company registered with the Arizona Corporation Commission (ACC).

However, there is a company named Black Top Solutions, LLC, which is apparently the company’s registered name, while using the name Black Top Strategies for its website.

Black Top owner Andrew Chavez claims his attorney corrected the name discrepancy three weeks ago with the ACC and has changed its corporate identity to match its website name.

Chavez also owns AZ Petition Partners, accused in 2008 of being responsible for getting a record number of citizen initiatives booted off the ballot due to fraud.

Petition Partners used subcontractors who allegedly falsified petitions, lied to voters about what they were signing and collected voter registration cards that were never turned in.

It resulted in tens of thousands of signatures being thrown out.

In October 2011, Petition Partners and Chavez were sued in federal court in District of Kentucky under the Racketeering Act of 1962 (RICO) by Kenton County Attorney Garry Edmondson.

Edmondson is accusing Chavez, his company and subcontractors of forging names on petitions and mail fraud.

According to 18 USC § 1961(5), a pattern of racketeering activity requires at least two acts of racketeering activity, including acts relating to fraud in connection with identification documents and mail fraud.

And, a voter registration form is considered an identification document.

According to the complaint, “Under Kentucky law, a person is guilty of forgery in the second degree, a felony, when, with intent to defraud or deceive another, he falsely makes, completes or alters a written instrument which is, when completed, a public record or an instrument filed or authorized by law to be filed in or with a public office or public employee.”

The complaint includes affidavits from two local doctors who assert they did not sign the petitions and the addresses used were their business addresses rather than their residential addresses.

According to Chavez, anyone can be sued and in the 15 years he’s been in business and completed 400 projects across the country in 16 states, collecting more than 5 million signatures, this is the only time he’s ever been sued. It was also the first time he had ever worked in Kentucky.

Caudle said Chavez was highly recommended by lobbyists and legislators as the “got-to” guy to get the job done. However, he also said had he known Chavez was being sued in a civil racketeering case he never would have contracted with him.

If more than 50 percent of Rio Verde Foothills residents decide to form this special taxing district, opponents are questioning what could come next – a water district, a road improvement district, a street light district – the taxing possibilities are endless.